Sometimes life doesn’t go as planned.

These helpful benefits can bring peace of mind when you’re hit with unexpected medical expenses.

These types of benefits are paid directly to you. You can use them to help offset out-of-pocket costs such as copays, deductibles and out-of-network costs. In addition to your healthcare and company-provided benefits (like basic life insurance), voluntary benefits can lessen your financial stress when the unplanned becomes a reality.

You can enroll for these benefits on Asurion Benefits Central either during your new hire benefits enrollment or during Annual Benefits Enrollment. Visit Asurion Benefits Central through Homebase with single sign-on access, or at asurion.benefitsnow.com with your username and password.

Accidents can happen any time, and treatment can knock a household budget off course. With MetLife Accident Insurance, you’ll receive a cash benefit paid directly to you, not your healthcare provider, so you can use the money however you want. This benefit is in addition to any costs that your medical plan may pay.

Getting a diagnosis for a critical illness can take you by surprise. With MetLife’s Critical Illness Insurance, you’ll receive a lump sum payment of $7,500 to $30,000 to help offset expenses for ongoing treatments or medical needs. Critical Illness Insurance includes coverage for illnesses like cancer, end stage renal disease, heart attack or stroke, and more. Limitations vary by state, so take a look at your options on Asurion Benefits Central – Additional Benefits section.

Hospitalization can be expensive and have a big impact on your life. Hospital Indemnity Insurance provides a direct lump-sum payment—one convenient payment all at once—if you or a family member is hospitalized.

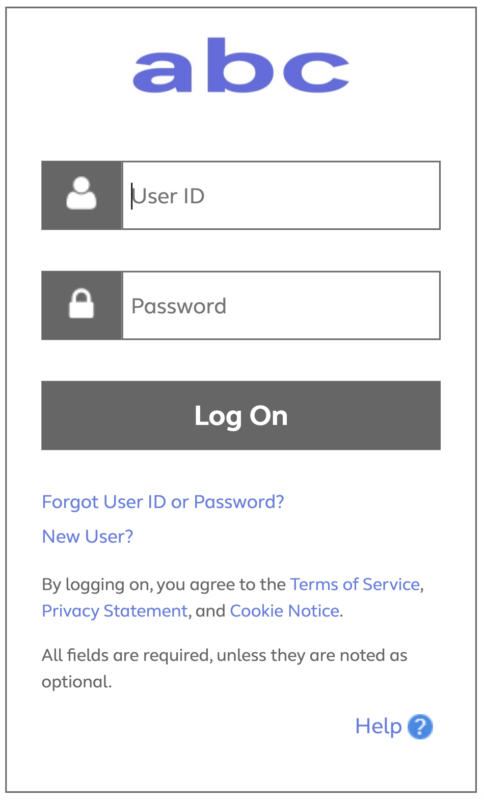

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Use the pricing tool to estimate your out-of-pocket expenses before you lock-in your healthcare coverage choices. After you click the link, you’ll be directed to a log-in page that will require a password that you can request from your Human Resources Business Partner.