Vision care is an important part of an overall preventive care strategy. Did you know that an eye exam can detect many health conditions like diabetes, high blood pressure, thyroid disease and even some cancers?

We understand that everyone has different healthcare needs and budgets. So, you’ll find a similar spectrum of coverage options through Asurion Benefits Central for vision care as we offer for medical and dental coverage.

BRONZE PLUS |

SILVER |

GOLD |

|

|---|---|---|---|

|

Note:

|

|

|

|

|

ANNUAL VISION EXAM |

100% covered |

You pay $20 |

You pay $10 |

|

FRAMES |

Discount may apply |

$100 allowance1 |

$200 allowance1 |

|

LENSES

|

Discount may apply |

You pay $20 |

You pay $10 |

|

LENS ENHANCEMENTS |

|||

|

Discount may apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT LENSES

|

|

|

|

Your cost of coverage (“premiums”) are deducted from your paycheck before taxes are added.

You can pay your copayments and coinsurance by:

What you’ll pay for coverage is just one consideration. Another important factor is whether you have kids, because kids often need glasses and/or may have activity-related accidents that could require an eye doctor. You also should think about genetics—in other words, if your parent or sibling has had eye conditions, there’s a good chance you also may.

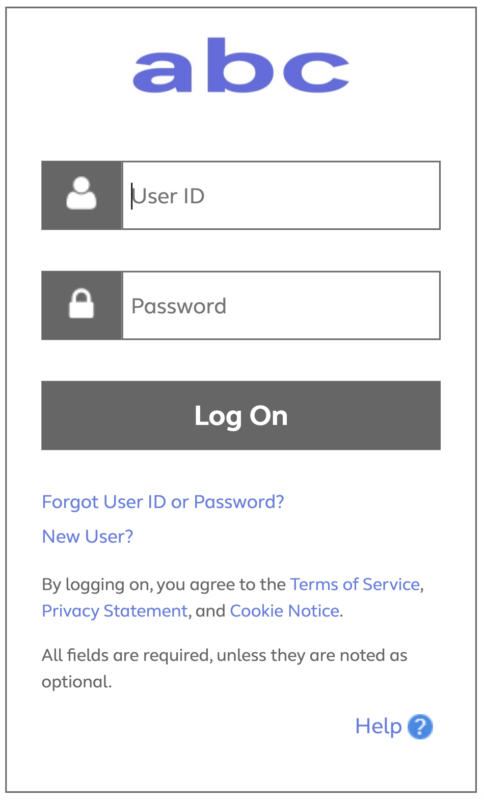

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Use the pricing tool to estimate your out-of-pocket expenses before you lock-in your healthcare coverage choices. After you click the link, you’ll be directed to a log-in page that will require a password that you can request from your Human Resources Business Partner.