Peace of mind comes from knowing that you’re prepared for the future to the best of your ability, and a significant piece of that strategy is your financial plan.

That’s why Asurion provides a 401(k) retirement savings account for employees, and offers you expert financial advice through Financial Finesse. As you’re assessing your healthcare needs, take the time to plan for the financial security of yourself and your loved ones using these tools and resources.

The names “Accident, Critical Illness and Hospital Indemnity Insurance” make most people think these optional coverages round out your medical insurance plan. Actually, these three provide a cash payment should you or a covered dependent suffer a condition as defined by the plans. Click the links above to learn more.

You have basic Life and Accidental Death and Dismemberment insurance provided by Asurion, as well as buy-up coverage options. You also may choose group universal life insurance coverage with a long-term care provision. Click the link above to learn more.

It’s become common for adults today to be caring for their children and their parents or grandparents at once. That’s why we’re offering group universal life insurance in addition to Asurion-provided and supplemental life insurance. Besides the typical death benefit payout you would expect from a life insurance plan, this voluntary coverage includes a long-term care (LTC) provision that is paid whether care is provided through a nursing home or assisted living facility; by a licensed home health provider; or a loved one.

The Group Universal Life policy, which is available to employees and spouses, is portable, payout is unrestricted and benefit rates will not increase with age. All coverage is guaranteed for individuals up to age 80; there is no medical screening or testing required.

The policy includes an Accelerated Death Benefit for Chronic Condition Rider, which allows you to access a portion of your life insurance benefit every month when you or your spouse cannot perform your regular activities for daily living, like bathing, getting dressed or eating. You can receive 4% of your life insurance policy value per month for up to 25 months if you lose the ability to perform two or more activities of daily living (ADLs). This provision may be extended, up to 25 months (50 months total), if needed. In this case, the carrier will issue a 25% paid-up life policy.

When you have an illness or injury, Short- and Long-Term Disability provides financial protection by replacing a portion your income.

Asurion provides basic STD benefits automatically to eligible employees. You’re automatically enrolled in these benefits.

|

Plan |

% of Base Pay |

|---|---|

|

Basic STD |

50% up to $5,000 per week |

|

Basic LTD |

50%, up to $20,000 per week |

In addition to the basic coverage provided by Asurion, you have the option to purchase additional STD and LTD coverage to replace a larger portion of your income while recovering from an illness or injury.

All percentages are based on your base pay. Note: At five years of service, you’re automatically enrolled in the buy-up plans at no cost to you.

|

Plan |

Buy-up purchase option |

Total benefit when combined with basic benefit |

|---|---|---|

|

Buy-up STD |

20% |

70% up to $7,000 per week |

|

Buy-up LTD |

16-2/3% |

66-2/3% up to $20,000 per week |

Save for retirement and get a company match through the Asurion 401(k) savings plan.

You can contribute pretax dollars to a traditional pretax 401(k) or an after-tax Roth up to IRS limits.

Eligibility to participate begins on the first of the month following 30 days of employment. As a new hire, you’re automatically enrolled at 3% of your pay once you’ve met the eligibility requirements. After your first year of service, Asurion will match 100% for the first 3% of your contribution and 50% on the next 2%.

You can make changes to your contributions anytime and you’re always 100% vested in your contributions and company match contributions.

Visit www.principal.com or call 800.547.7754 to:

Asurion has partnered with Alliant Credit Union to offer you the perks of an online credit union membership, such as:

Benefits include:

Ready to join? It’s quick, easy and free!

Getting started is easy. It only takes a few minutes to apply.

Learn more and enroll by visiting AlliantCreditUnion.com/Asurion or call 800.328.1935.

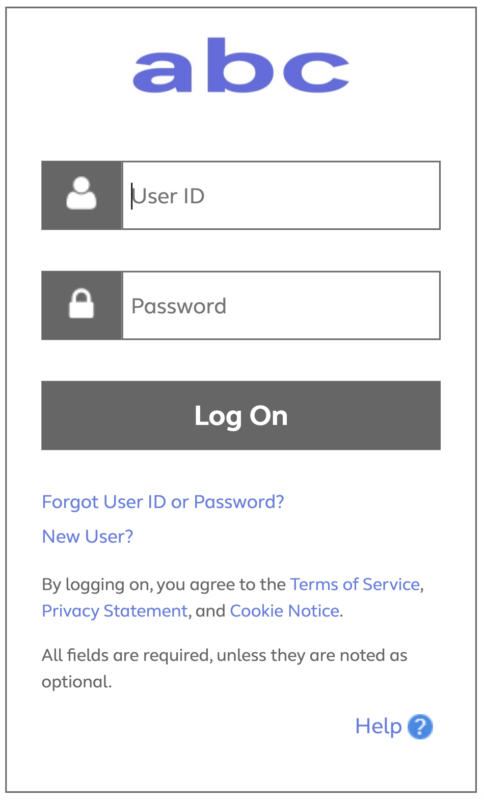

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Use the pricing tool to estimate your out-of-pocket expenses before you lock-in your healthcare coverage choices. After you click the link, you’ll be directed to a log-in page that will require a password that you can request from your Human Resources Business Partner.