Employees who work less than 30 hours per week may choose among a Basic Plan, an Enhanced Plan and an Enhanced Plus Plan. You also may elect dental and/or vision coverage.

The Aetna medical coverage option for part-time employees is not a major medical plan but provides benefits and discounts to help reduce your out-of-pocket medical costs. Fixed benefits are paid for doctor’s visits, medical imaging, prescriptions and hospital services. Though providers are paid directly, this plan does not pay the full cost of medical care. You are responsible for making sure your charges are completely satisfied.

You may choose between a Basic Plan, an Enhanced Plan and a new Enhanced Plus Plan. Enhanced and Enhanced Plus have higher allowances in exchange for higher premiums. Log in to Asurion Benefits Central to see your costs and benefit options.

|

Benefits |

Basic |

Enhanced |

Enhanced Plus |

|---|---|---|---|

|

Covered benefits for inpatient stays |

|||

|

Hospital stay—admission |

$500 |

$700 |

$1,100 |

|

Hospital stay—intensive care unit (ICU)—admission |

$1,000 |

$1,400 |

$2,200 |

|

Hospital stay—daily |

$200 |

$500 |

$7,500 |

|

Hospital stay—ICU daily |

$400 |

$1,000 |

$2,200 |

|

Newborn routine care |

$100 |

$300 |

$400 |

|

Observation unit |

$100 |

$300 |

$400 |

|

Substance abuse stay—daily |

$200 |

$500 |

$750 |

|

Mental disorder stay—daily |

$200 |

$500 |

$750 |

|

Rehabilitation unit stay—daily |

$200 |

$500 |

$750 |

|

Skilled nursing facility stay—daily |

$200 |

$500 |

$750 |

|

Hospice care—daily |

$200 |

$500 |

$750 |

|

Covered benefits for surgery |

|||

|

Inpatient surgery |

$200 |

$450 |

$675 |

|

Outpatient surgery—hospital outpatient or ambulatory surgical center |

$200 |

$450 |

$675 |

|

Outpatient surgery—doctor’s office, urgent care facility or hospital emergency room |

$50 |

$100 |

$150 |

|

Covered benefits for doctor’s visits |

|||

|

Doctor visits—office / urgent care facility |

$50 |

$70 |

$90 |

|

Doctor visits—walk-in-clinic / telemedicine visit |

$25 |

$35 |

$60 |

|

Covered benefits for outpatient services |

|||

|

Ambulance—ground |

$100 |

$100 |

$100 |

|

Ambulance—air |

$500 |

$500 |

$500 |

|

Emergency room |

$100 |

$275 |

$475 |

|

Equipment and supplies |

$20 |

$45 |

$65 |

|

X-ray and lab |

$25 |

$50 |

$100 |

|

Covered benefits for outpatient services |

|||

|

Medical imaging |

$150 |

$250 |

$250 |

|

Prescription drugs |

$20 |

$45 |

$65 |

|

Additional covered benefits |

|||

|

Accidental injury treatment |

$100 |

$300 |

$500 |

|

Lodging |

$100 |

$100 |

$100 |

|

Transportation |

$100 |

$100 |

$100 |

|

Prescription drugs |

|

|

We will pay the prescription drugs benefit amount shown in the schedule of benefits section of your certificate for each day you have a prescription filled. Prescription drugs must be dispensed by a licensed pharmacist on an outpatient basis. The prescription drugs benefit amount will not be paid for:

|

Some benefits of choosing this coverage include:

This coverage covers a portion of your bill for common dental procedures.

|

Dental Plan Benefits |

|

|---|---|

|

Maximum benefit per coverage year |

$500 |

|

Deductible per coverage year |

$50 |

|

Preventive services (includes checkups and cleanings) |

Member is responsible for paying up to 20% of the Recognized Charges. These services have no waiting period. |

|

Basic services (includes fillings, oral surgery, and denture, crown, and bridge repair) |

Member is responsible for paying up to 40% of the Recognized Charges. Member needs to be enrolled in the dental plan without interruption for 3 months before the plan begins to pay for these services. |

|

Major services (includes perio and endodontics, crowns, bridges, and dentures) |

Member is responsible for paying up to 50% of the Recognized Charges. Member needs to be enrolled in the dental plan without interruption for 12 months before the plan begins to pay for these services. |

The plan requires that a deductible is met before a benefit is paid. A deductible is the amount a member must pay for eligible expenses before the plan begins to pay benefits.

This coverage reimburses you for an exam, frames and lenses, or contact lenses up to an annual limit.

|

Vision Plan Benefits |

|

|---|---|

|

Maximum benefit per coverage year for eye exams, frames, lenses, contacts and contact lens exams |

$100 |

Fees for other services must be paid by the member. Benefit period is 12 consecutive months beginning on the later of member’s effective date or member’s most recent eye exam covered under this plan. This plan, alone, does not meet Massachusetts Minimum Creditable Coverage standards.

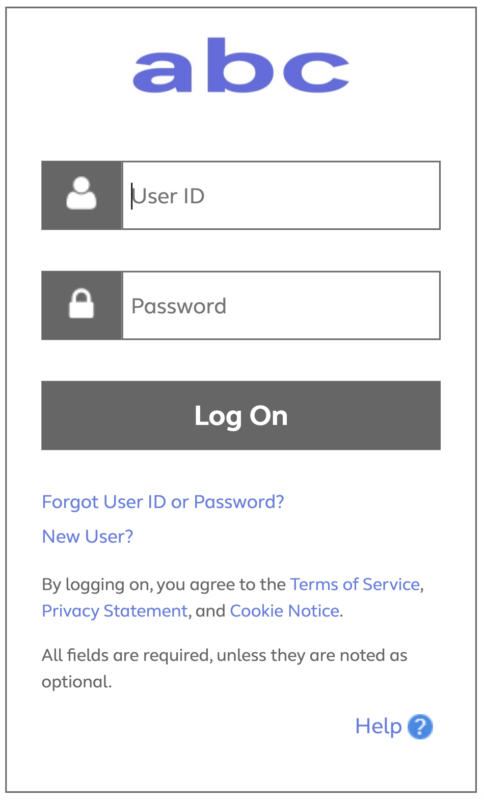

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Use the pricing tool to estimate your out-of-pocket expenses before you lock-in your healthcare coverage choices. After you click the link, you’ll be directed to a log-in page that will require a password that you can request from your Human Resources Business Partner.

“Last year’s flu season was pretty bad. I try to take good care of myself and thought I’d be safe. Then I got so sick from the flu, it turned into pneumonia. After a visit to urgent care, X-rays, lab work, a couple of follow-up visits with a regular doctor and two prescriptions, my out-of-pocket medical costs ended up being: $430.”

“That’s a lot, but if I didn’t have my Aetna Basic PPO Plan, I would’ve paid more. I owed $620 but the plan paid $190 in benefits.”

|

PLAN PAYS |

|

|

Urgent care (initial visit) |

$50 |

|

Lab work |

$25 |

|

Chest X-ray |

$25 |

|

Prescription (2 separate days) |

$40 |

|

Doctor’s Office (2 follow up visits) |

$50 |

|

TOTAL |

$190 |

“I’m glad I took care of it when I did or I could’ve ended up in the hospital. It also helped that I had access to Aetna’s national provider network. Thanks to the discounted services, I ended up saving about 35% on the care I needed. They really make it easy to find an in-network doctor online. And the money I saved by staying in network made a big difference in my out-of-pocket costs.”

This example shares some common things covered by the plan. But check out the benefit summary for more details. It shows what the plan covers, including exclusions and limitations that apply.