I’m not feeling well, where should I go?

For options on where you can get care when you’re not feeling well.

The United Essential PPO plan may be the right choice for you if:

You want low per-paycheck contributions, i.e., premiums.

And

You like predictability; to know exactly what you’ll pay when you see a provider or fill a prescription, i.e., copayments (copays).

Your Cost

How much you’ll pay for a medical plan is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Log in to the ABC to see premiums for each medical plan based on coverage level |

Primary: $30 |

Employee only: $4,000 |

Flexible Spending Account |

|

|

|

|

A Flexible Spending Account may be a smart way to manage your out-of-pocket healthcare expenses for the year. Just remember that you have to use the balance in your FSA annually or you forfeit the remainder. The United Essential PPO plan offers you the same doctors as the United Enhanced PPO plan, but with lower premiums and a higher deductible.

The United CDHP with HSA plan may be the right choice for you if:

You want low per-paycheck contributions, i.e., premiums.

And

You don’t expect to use a lot of medical services, or you can easily afford an expense like an unexpected doctor’s visit or prescription.

And

You want to save money for healthcare expenses — including your deductible and coinsurance, as well as future needs — in a pre-tax Health Savings Account.

Your Cost

How much you’ll pay for a medical plan is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Log in to the ABC to see premiums for each medical plan based on coverage level |

You must pay the total cost of your service until you reach the deductible |

Employee only: $2,500 |

Health Savings Account |

|

|

|

|

A Health Savings Account is available only with the United CDHP with HSA plan because it is a consumer-driven health plan (CDHP).

are pre-tax (so your gross pay is lower for tax purposes, too)

accrues untaxed

Bottom line: If you need predictability in cost or don’t want to save money in an HSA, the United CDHP with HSA plan probably will not be a good fit.

The United Enhanced PPO plan may be the right choice for you if:

You want a low annual deductible in exchange for higher premiums.

And

You like predictability—to know exactly what you’ll pay when you see a provider or fill a prescription, i.e., copayments (copays).

Your Cost

How much you’ll pay for a medical plan is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Log in to the ABC to see premiums for each medical plan based on coverage level. |

Primary: $25 |

Employee only: $1,000 |

Flexible Spending Account |

|

|

|

|

A Flexible Spending Account may be a smart way to manage your out-of-pocket healthcare expenses for the year. Just remember that you have to use the balance in your FSA annually or you forfeit the remainder.

The chart below compares the three UnitedHealthcare plans.

If you live in one of the six regions served by Kaiser, check out the three plans available to you.

Compare your paycheck premiums for Asurion’s 2026 healthcare plans at different coverage levels.

Contact the ABC for the access code.

|

United Essential PPO |

United CDHP with HSA1 |

United Enhanced PPO |

|

|---|---|---|---|

|

CLOSEST 2025 PLAN |

bronze |

silver |

gold |

|

Deductible (Rx + Medical) Individual | Family |

$4,000 | $8,000 |

$2,500 | $5,000 |

$1,000 | $2,000 |

|

Coinsurance |

20% |

20% |

20% |

|

Maximum Out-of-Pocket Individual | Family |

$8,000 | $16,000 |

$5,000 | $10,0001 |

$3,500 | $7,000 |

|

Office Visits PCP | Specialist |

$30 | $50 |

Deductible, then coinsurance |

$25 | $50 |

|

Labs, X-rays, Advanced Radiology, Hospital Services (inpatient or outpatient) |

Deductible, then coinsurance |

Deductible, then coinsurance |

Deductible, then coinsurance |

|

Urgent Care |

$60; no deductible |

Deductible, then coinsurance |

$50; no deductible |

|

Emergency |

$300, then deductible/coinsurance |

Deductible, then coinsurance |

$300, then deductible/coinsurance |

|

PRESCRIPTIONs |

|||

|

1. Generic |

1. $10 |

$0 Preventive; otherwise, deductible, then coinsurance |

1. $10 |

|

Healthcare Flexible Spending Account Available? |

Yes |

Yes, for dental and vision expenses only |

Yes |

|

Health Savings Account Available? |

No |

Yes |

No |

|

Company Matching Contributions? |

No |

Yes |

No |

Participants automatically get free access to this proven online weight management support program.

Choose a membership tier that fits your lifestyle and provides everything you need for whole body health in one easy, affordable physical fitness and total body wellbeing plan. (Note: Some state restrictions apply.)

For options on where you can get care when you’re not feeling well.

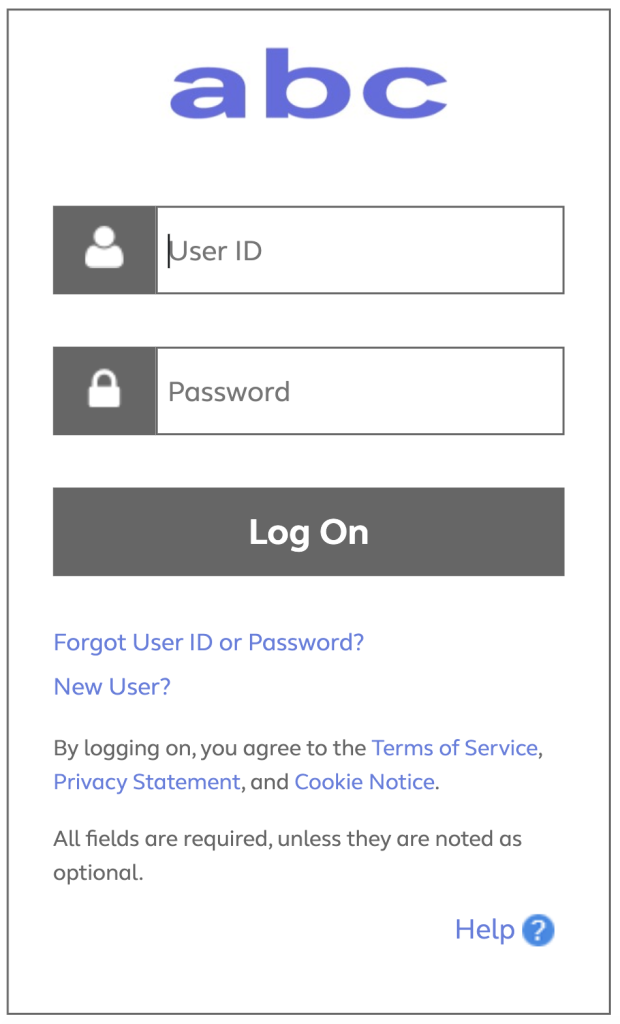

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.

No events found.

Text “Benefits” to 67426 to have a link sent to your phone. Then, click the link to download the Alight Mobile app so you can access all the functions of the ABC on the go. (You’ll need to set your “Primary Phone” in Workday as your mobile number for full functionality.)