You are valuable! Because we truly believe this, we provide Basic Life and AD&D coverage to all employees who work 30+ hours per week, and we offer a buy-up option for more protection.

Eligible employees are automatically enrolled for Basic Life and Accidental Death and Dismemberment insurance. The amount you or your beneficiary would receive is equal to one times your base salary, rounded to the nearest $1,000, with a maximum of $200,000. Asurion pays the full cost for this benefit.

Please note: Life insurance above $50,000 is taxed by the federal government. The value of the premiums as determined by the IRS is reported as imputed income.

You may supplement company-provided Basic Life and AD&D insurance with additional protection.

|

Supplemental Life |

Supplemental AD&D |

|

|---|---|---|

|

This coverage pays your beneficiaries beyond the Basic coverage provided by Asurion in the event of your untimely death. |

This policy pays your beneficiaries a cash benefit in the event of a fatal accident, or to you if you suffer an unexpected event that causes loss of hearing, speech or a limb. |

|

|

Employee |

|

|

|

Spouse |

|

With child AD&D coverage

Without child AD&D coverage

|

|

Child (per child) |

|

With spouse AD&D coverage

Without spouse AD&D coverage

|

Use Benefit Scout™ to find out, and see your rates at LifeBenefits.com/Asurion

The names “Accident“, “Critical Illness” and “Hospital Indemnity Insurance” make most people think these optional coverages round out your medical insurance plan. Actually, these three provide a cash payment should you or a covered dependent suffer a condition as defined by the plans. Click the links above to learn more.

Short-term and long-term disability insurance replaces a portion of your income while you are recovering from an illness or injury.

Asurion provides core STD and LTD automatically to eligible employees. You have the option to purchase additional disability protection during your benefits enrollment as a new hire, or during Annual Enrollment. If you have five years of service, you are automatically enrolled in the STD and LTD Buy-up options at no cost to you.

|

Short-term Disability (% of base pay) |

|

|---|---|

|

Basic STD |

50%, up to $5,000 per week |

|

STD Buy-up |

70%, up to $7,000 per week |

|

Long-term Disability (% of base pay) |

|

|---|---|

|

Basic Ltd |

50%, up to $20,000 per week |

|

Ltd Buy-up |

66-2/3%, up to $20,000 per week |

If you’re on the Asurion network, click here to learn more.

Save for retirement and get a company match through the Asurion 401(k) savings plan.

You can contribute pre-tax dollars to a traditional pre-tax 401(k) or an after-tax Roth up to IRS limits.

As a new hire, you’re automatically enrolled at 3% of your pay once you’ve met the eligibility requirements. After your first year of service, Asurion will match 100% for the first 3% of your contribution and 50% on the next 2%.

You can make changes to your contributions anytime and you’re always 100% vested in your contributions and company match contributions.

Visit the plan’s website or call 800.547.7754 to:

Because planning for retirement requires an individualized approach, Asurion has engaged financial planners to help guide you toward the saving and investing approach that’s uniquely right for you. Take advantage of one-on-one virtual meetings with a retirement expert and helpful online resources at no cost to you.

Want to learn more about financial topics that are of interest to you?

Go to principal.com/Milestones.

Sign up for a virtual one-on-one meeting.

Visit principal.com/Virtual1on1 to get started.

Asurion has partnered with Alliant Credit Union to offer you the perks of an online credit union membership.

Benefits include:

Learn more and enroll by visiting AlliantCreditUnion.com/Asurion or call 800.328.1935.

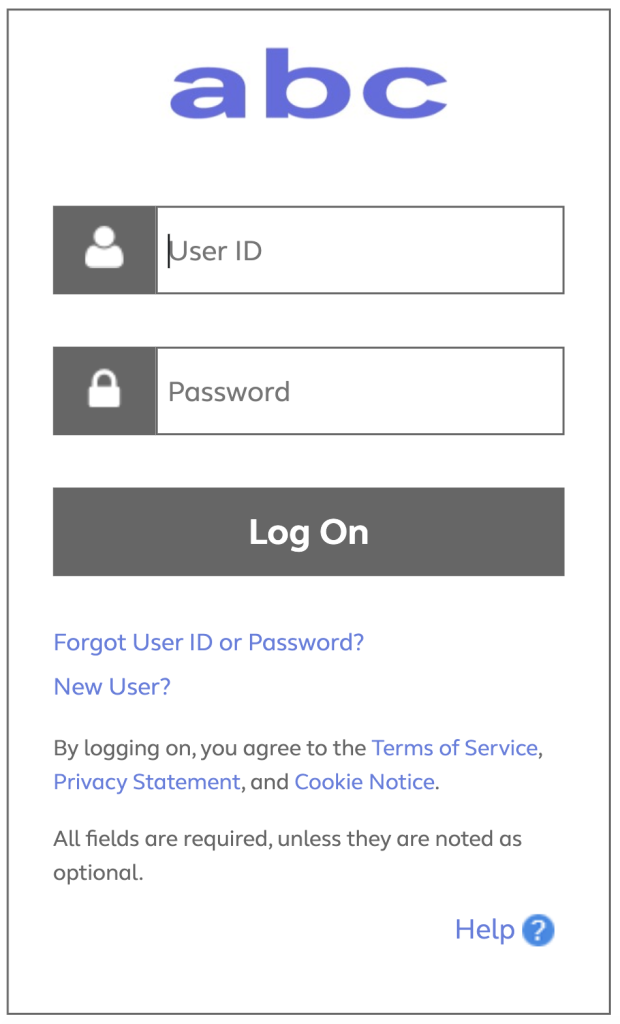

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.

No events found.

Text “Benefits” to 67426 to have a link sent to your phone. Then, click the link to download the Alight Mobile app so you can access all the functions of the ABC on the go. (You’ll need to set your “Primary Phone” in Workday as your mobile number for full functionality.)