It’s important to understand some basics.

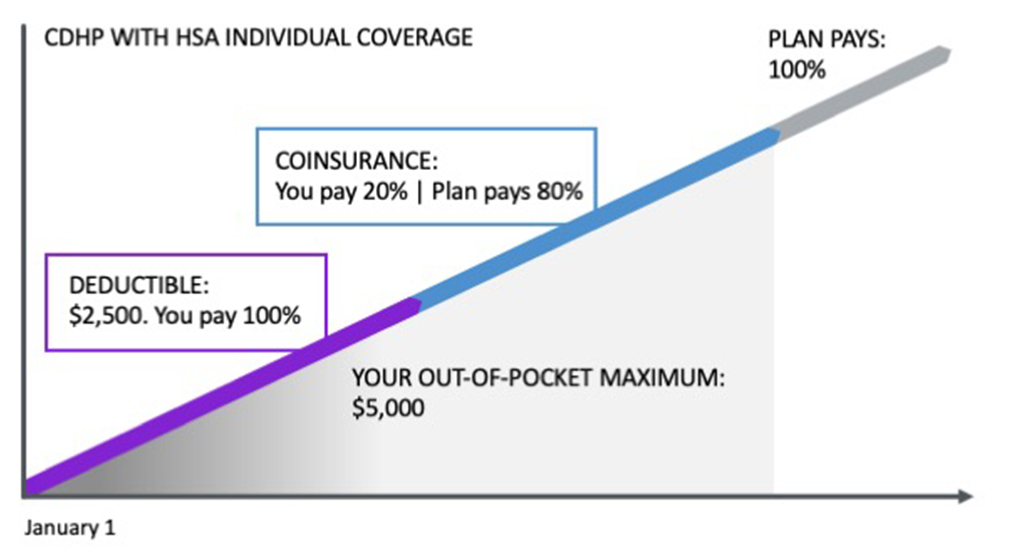

In the example below, if you start at the left side of this chart, that’s where you’re at on January 1. After you meet the annual out-of-pocket maximum, the plan pays 100% of the remaining cost through the end of the year. Don’t forget that your HSA is available to help cover your out-of-pocket costs.

The CDHP features a True Family deductible, which means that if you cover any dependent(s), you must meet the full Family deductible before coinsurance begins for any covered individual. A similar truth applies to the plan’s annual maximum out-of-pocket amount, as well: that amount must be met before any covered individual qualifies for $0 cost.

While Asurion paycheck deductions for healthcare are tiered for Individual, Employee + Spouse, Employee + Child(ren) or Employee + Family coverage, the IRS annual deductible and maximum out-of-pocket amounts for CDHPs are based on only two options, either Individual or Family (covering one or more dependent(s)) coverage.

Your deductible is a flat dollar amount of covered healthcare expenses that you pay out of pocket before expenses are shared through coinsurance. Depending on your plan option, there may be situations where the deductible does not apply. For example, this may be the case with certain preventive services or where copayments apply.

Be aware that there are separate deductibles for in- and out-of-network expenses. For the CDHP, if you cover any dependent(s), expenses must meet the Family deductible before any applicable coinsurance will apply. This is called a “True Family” deductible and does not apply to the PPO options. Under the PPOs, coinsurance will apply for any individual once that person reaches the Individual deductible, or for all covered persons once the total Family deductible is met.

Your deductible and coinsurance are the costs you pay. Note that premiums do not count toward the deductible.

The amount of your in-network deductible depends on the plan you choose:

|

Individual |

Family |

|

|---|---|---|

|

Essential PPO |

$4,000 |

$8,000 |

|

CDHP with HSA |

$2,500 |

$5,000 |

|

Enhanced PPO |

$1,000 |

$2,000 |

When your covered healthcare expenses exceed the deductible, you and the plan begin sharing the cost by paying a percentage called coinsurance. Your deductible and coinsurance are the cost that’s passed on to you.

In all three options, your in-network coinsurance is 20%. While Asurion continues to cover the majority of employee healthcare costs, each covered individual has a responsibility to use our benefits in the smartest way possible.

The out-of-pocket maximum is the total amount you could pay within a plan year for eligible medical care and prescriptions. It does not include premiums taken out of your paycheck for health coverage. If you reach this maximum during the plan year, the plan pays 100% of covered services for the rest of the plan year.

|

Individual |

Family |

|

|---|---|---|

|

Essential PPO |

$8,000 |

$16,000 |

|

CDHP with HSA |

$5,000 |

$10,000 |

|

Enhanced PPO |

$3,500 |

$7,000 |

Copays (short for “copayments”) are a fixed amount for a covered service collected when you see your provider, unless you have the CDHP.

Your copays depend on the plan you choose:

|

PCP (Primary Care Physician) |

Specialist |

Urgent Care |

|

|---|---|---|---|

|

Essential PPO |

$30 |

$50 |

$60 |

|

CDHP with HSA |

Deductible, then coinsurance |

||

|

Enhanced PPO |

$25 |

$50 |

$50 |

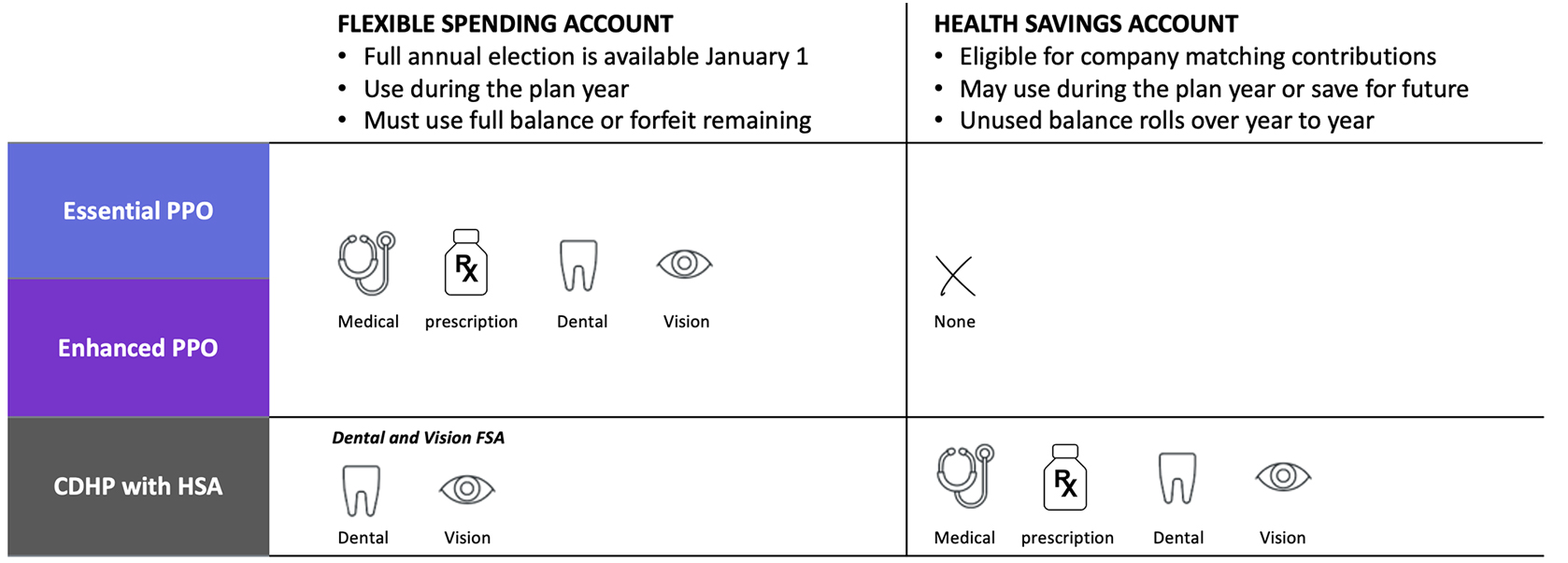

Health Savings Account (HSA)

If you are in the CDHP, you can pay your deductible and/or coinsurance with any funds available in your HSA using your SmartChoice debit card, which all participants receive after enrolling in a CDHP with HSA. You make contributions to the account through payroll deductions and will receive company matching contributions. Unlike a Flexible Spending Account, you don’t lose the money in your account from year to year. In fact, you can save your money and even invest it, taking advantage of the potential to grow your account even larger through tax-free earnings.

You also have the option to pay with your own funds via another means, and can request a reimbursement from your HSA, if you so choose.

Healthcare Flexible Spending Account (FSA)

If you have the United Enhanced PPO, the Kaiser Enhanced HMO, the United Essential PPO or the Kaiser Essential HMO, you may pay with any available FSA funds using your SmartChoice debit card, which you’ll receive as an FSA participant. Or, you may pay by another means and get reimbursed.

If you have both an HSA and a Dental and Vision FSA, you’ll use the same SmartChoice card to access both accounts. The SmartChoice card will automatically pay eligible dental and vision expenses from your FSA first, since those funds are use-it-or-lose-it. That’s smart!”

Using in-network providers is a smart strategy for keeping your healthcare costs as low as possible. If you do choose to use out-of-network providers, be aware that in-network and out-of-network costs accumulate separately, and you will pay more out of pocket to meet both the in- and out-of-network deductibles.

Out-of-network providers are not held to the same pricing guidelines as in-network providers. They can charge whatever they want, even if a fee for a common service is well above average for the area. The reimbursement for out-of-network providers is a lower percentage AND the insurance carrier will only pay based on what they consider to be reasonable and customary. As a result, you end up paying even more out of pocket because out-of-network doctors will bill you for the cost difference that insurance doesn’t cover.

Consider this example of treatment for an ACL knee injury that compares in-network versus out-of-network costs.

|

In-Network |

Out-of-Network |

|

|---|---|---|

|

Provider Billed |

$10,000 |

$10,000 |

|

Network Discount |

$6,500 |

Not applicable |

|

Amount Allowed |

$3,500 |

$4,200 |

|

Health Plan Paid |

$2,800 |

$3,360 |

|

Your Responsibility |

$700 |

$840 |

|

Potential Balance Bill from the Provider to You |

Not applicable |

$5,800 |

|

Potential Member responsibility |

$700 (Your Responsibility + Balance Bill) |

$6,640 (Your Responsibility + Balance Bill) |

|

Difference of $5,940 |

The Annual Enrollment period is the only time you’re permitted to make changes to your coverage unless you experience a qualifying life event (QLE). Examples of a QLE are when you give birth or adopt a child; become a guardian or foster parent; get married or divorced; or one of your dependent(s) becomes eligible or ineligible for coverage due to a job change, birthday (age 26) or disability status.

If you experience a QLE during the plan year, visit the ABC and find out what benefit changes the event permits. Only changes relevant to the event are accepted, and you will be required to provide documentation certifying the event. On Homebase, you’ll find a chart showing the acceptable documentation that you are required to submit.

QLE benefit changes must be made within 30 days of the event. If you miss the 30-day deadline, you’ll have to wait until the next Annual Enrollment period to make a change to your coverage.

Asurion offers voluntary benefits to round out your coverage. These options are terrific if you want coverage “just in case” an unexpected event comes your way, instead of buying more expensive insurance (over-insuring) for yourself and your family. They can help you cover unexpected out-of-pocket costs. They can help you cover unexpected out-of-pocket costs. Learn more about Accident, Critical Illness and Hospital Indemnity voluntary coverage options to supplement medical coverage.

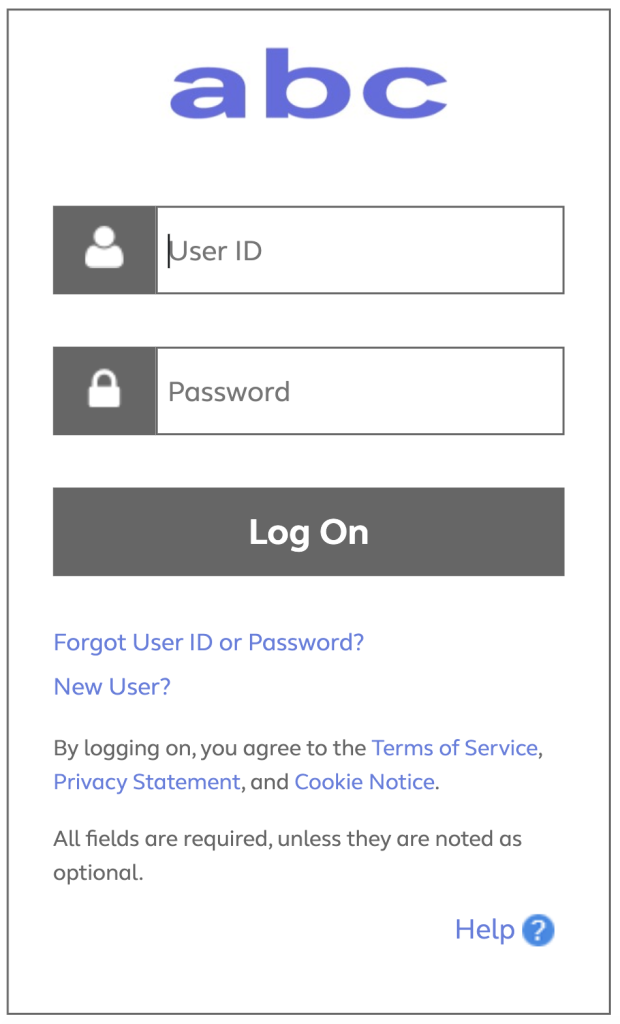

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.

No events found.

Text “Benefits” to 67426 to have a link sent to your phone. Then, click the link to download the Alight Mobile app so you can access all the functions of the ABC on the go. (You’ll need to set your “Primary Phone” in Workday as your mobile number for full functionality.)